Welcome to the 108 new readers of The Business Academy.

The 🔑 key to success is information.

I’ll be distilling the most impactful information I picked up over the last week so you don’t have to.

Today’s Business Academy takes 6 minutes and 58 seconds to read.

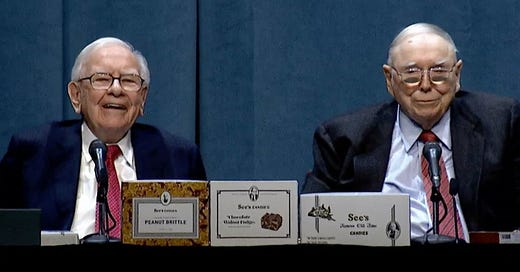

🔑#1- What I learned from Charlie and Warren.

I finally did it.

After a decade of desire…I made the pilgrimage to the Berkshire Hathaway Shareholder Event.

Here are some of my learnings from the event…

(my favorite learnings at the top)

Celebrate Capitalism…and be playful

Warren and Charlie host the only shareholder event that feels like a music festival. A celebration of capitalism. They run ads for their key companies at the beginning of the event, they have a tradeshow where you can buy products from the companies they own. And most importantly, they don’t take themselves too seriously. It’s hokey and playful.

Be Kind.

Warren has a favorite quote from one of his CEOs:

“you can always tell someone to go to hell tomorrow”.

Charlie and Warren both recommend you be kind to the people around you.

“I’ve never met anyone kind that died without friends. I’ve known plenty of people with a lot of money that died without friends”

The most important thing is longevity…

When I asked attendees after the event what their favorite part of the meeting was, every single person started with:

“I can’t believe how sharp they are at 92 and 99 years old!”

Nobody celebrated their hundreds of billions of wealth, or heroic feats.

It turns out everyone wants to know how to live long, and stay sharp throughout your life. So protect your body and your mind. If you can avoid it, don’t retire!

Their instructions on how to live a good life

Spend less than you earn

Invest your money

Don’t surround yourself with toxic people

Know how people who manipulate other people, and resist the urge to do it yourself

Write your Obituary and try to live your life accordingly

Is the US at risk of losing its place as the reserve currency?

“I see no other option for any other currency to be the reserve currency” - WB

“We can do a lot of dumb things and get away with it, we can’t do an unlimited number of dumb things.” - WB

It’s the government’s job to operate in a fiscally responsible way. If we don’t do that for a long period of time, it will decrease other countries belief in our country’s economy which could lead to long term pain.

Ignore Finance Professors

A professor and podcaster stated that if a stock makes up more than 35% of a holding company, it can be considered dangerous.

Charlie Munger’s responded

“I think he’s out of his mind”

Two lessons

When you find a company that is better than the rest, don’t sell it because of some arbitrary targets. Hold on tight.

Be careful. There are so many finance professors and educators out there that are just wrong. Remember, if they had the perfect plan, they would be very rich themselves.

On Investing in America

“US is a better place to live than when I was born by many magnitudes”

“You can romanticize about the past but forget it!”

“My dad was a congressman in 1940, and the government was a mess back then.”

“If I had the choice. I would choose to be born in the United States and I would choose to be born TODAY.” - Warren Buffett

Stop romanticizing the past, we list in the best moment in history. These guys that have been around 100 years and have seen every moment have told us so.

On Estate Planning

What should heirs do after your parents die and give you an asset?

“Just hold the goddam stock” - Charlie Munger

You need to prepare your kids for what they’re inheriting. Talk to them. Share your values.

“I don’t sign my will until my kids have seen it, and offered suggestions”

“Live your values, and talk about them with your kids” - Warren Buffett

We hosted an Enduring Ventures meet-up in Omaha :)

🔑#2- Our Shareholder Event.

Two weeks ago we hosted our shareholder event in Miami.

The room was full of builders, people who owned small businesses and holding company owners.

A few takeaways on hosting an event.

Plan an event you would like to attend. Don’t host an event to impress your attendees. We host the event we would want to attend. It attracts the type of people we want to surround ourselves with.

We’re both pretty down to earth. So we avoid fancy stuffy hotels and expensive restaurants. We hosted the event at a simple boutique hotel with a good vibe. They didn’t have conference space so we huddled in their “living room”, sat on the floor etc…

We care about activities. We want people to bond outside of just food and content sessions. So we bring people to lead yoga, workout classes, breath work, art classes and we even played beach Ultimate Frisbee. These are all optional, but people who participated enjoyed it. Every year Xavier hosts a Business Trivia to kick-off the event. This is not optional and is a nice way to get some competition and comradery going.

Food. This one is really important to me. It hurts my heart to attend an event with bland conference good. Our event planner knows this and flies out to test all the food ahead of time so every meal is special.

Hire an event planner. The first year we hosted an event, one of our employees spent part of the year preparing for the event. It turned out well, but it was too much work and stress for me. I’ve since learned it pays to hire a professional. Blair and her company NoName Road specialize in hosting corporate events 40-150 people. She does it all. She even prepares flower arrangements for the entire event space.

A few learnings from our speakers

Jay Vas gave a talk on holding companies. His key insight was that great investors don’t focus on demand. They focus on supply. If they can compete in an industry with constrained supply they prefer that. Especially if they can buy up some of the other competitors.

That comment hit me like a ton of bricks.

My whole life I’ve been focused on demand!

I was told if I was starting a company I needed to pick an industry with a lot of demand. But with a lot of demand, and also a lot of supply you have no pricing power. Your competition will eat your margin away.

Jacob McDonough - wrote a book called “Capital Allocation” about the early years of Berkshire Hathaway.

His insight was: “Berkshire was built on the backs of three failed businesses, Berkshire textile mills, Blue Chip Stamps, Diversified Retailing”

There is some beauty in knowing that even the greatest investors we know today made major mistakes along the way.

My takeaway from this as a Holding Company owner is you can make mistakes along the way, as long as it doesn’t bring down your company.

So you should optimize your decisions around two things 1) getting your money back on an investment and 2) surviving a long time.

But don’t overoptimize growing fast, especially if it puts risk on the future of your company.

For example: taking debt can help you grow faster, but is risky and can bring your company down to zero.

Sahil Bloom is a friend of ours and has built one of the largest non-celebrity social followings on the internet. 1.5+ Million people follow him across different platforms.

He spoke about the power of building an audience and how it can be applied to business.

What stood out to me is you don’t need to build your audience for a specific purpose.

Because once you have a large audience, you’ll have endless opportunities to create value and wealth for yourself from that audience.

Before I started my journey on Twitter I thought it was best to have a specific goal in mind, or a product you wanted to sell.

That’s not true at all.

I’ve seen many people now build an audience and only then figure out what businesses make sense for them.

My most extreme and favorite example is the Kardashians. Kim Kardashian built a massive audience and following first. Today she owns a variety of businesses including Skims, a mobile game, makeup and now she’s a co-founder of a private equity fund.

Have a great week,

Sieva

ps: forward this email to someone you respect today