Welcome to the 349 new readers of The Business Academy.

The 🔑 key to success is information.

I’ll be distilling the most impactful information I picked up over the last week so you don’t have to.

Today’s Business Academy takes 7 minutes and 51 seconds to read.

Summary of today’s issue

🔑 #1 - How to fight 300 war ships, and win.

🔑 #2 - Business mistakes I made early on…

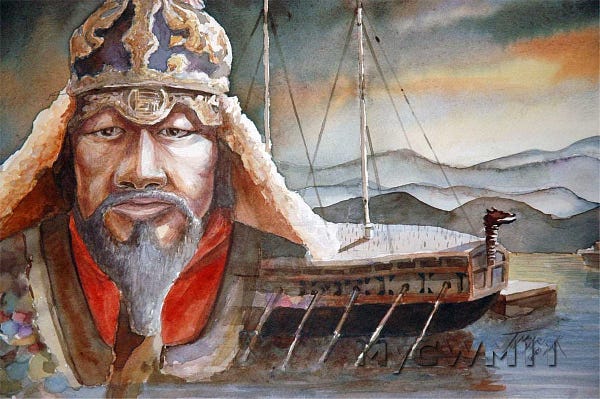

🔑#1 - One man VS 300 war ships

I’m a sucker for a tale like this…

Here is the story…

Korean admiral Yi Sun-Sin is sitting in jail for disobeying orders. A messenger for the king arrives to Yi’s cell to ask for help.

The Japanese are attacking their homeland with 300 ships. Korea only has 13 ships…

Yi’s mind springs to action.

He needs to drive the Japanese into a situation that gives his Korean army an advantage.

He knows a place that has a narrow channel so the Japanese can’t surround him. Importantly the tides change every 3 hours in this channel - something not many people know.

Yi’s army abandons him.

He’s alone in this bay as the Japanese ships approach.

Yi charges the ships…as he does the tides begin to move. The Japanese ships have nowhere to escape. They collide with each other.

Yi’s army see the Japanese are cornered so they attack. The Japanese flee for their lives.

You must be thinking… “Sieva…why are you telling me this silly folk story?”

Because I want you to remember…never underestimate your ability to create a HUGE impact.

Too many times I’ve heard people around me say: “our team is too small”, “we don’t have enough resources”, “this will never work”. I call these surrender phrases.

I don’t get upset easily, but saying one of those 3 surrender phrases to me ignites a fire of a thousand suns. Don’t try it.

The story of Yi Sun-sin made me think of another hero journey…

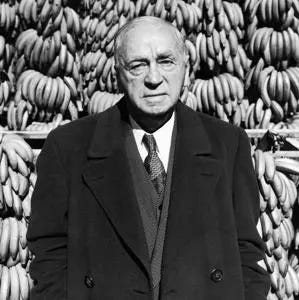

In 1891, Samuel Zemurray arrives in the United States as 13-year old poor Russian immigrant.

He will soon start a banana import company that grows to be one of the biggest companies in the world.

(this is Sam Zemurray)

Sam builds his business importing millions of bananas from Honduras.

Then in 1905, Honduras defaults on its $100M debt to the British government.

The US doesn’t want British war ships in Honduras, so the US Secretary of State asks JP Morgan to buy the debt.

In exchange he can collect import fees on all Honduran imports.

Well, Zemurray didn’t like this. He didn’t like it at all.

Why?

Because he had a special deal with Honduran government about his import fees. He paid less than everyone else.

So what does he do?

He starts a lobbying and marketing campaign against the plan.

The secretary of state calls him into his office and tells him to back off.

What does he do next?

He buys a 160-foot ex-Navy warship. Hires a group of mercenaries. And stages a coup to overthrow the Honduran government.

It works.

For placing the new Honrudan president he gets all his concessions and 20,000 acres of free Honduran land.

The best part about this?

Sam was 29 years old when he pulled off this coup. He had only been in the country for 15 years!

He outmaneuvered one of the greatest super powers at the time.

When your team tells you “we don’t have enough resources” to achieve your goal. Please share this story with them.

You can read the full book here. It’s excellent.

🔑#2 - Business Mistakes I made early on

This post inspired me to reflect on my own list of mistakes & learnings.

Unwind Contracts Are A Must

Have you heard of a Prenup?

If you’re getting into a partnership, you must have an unwind contract.

The contract should answer

how do you make decisions if you disagree?

what happens if one partner wants to leave in a few years? Do they have to sell stock back?

how will you value the company? You can select a 3rd party valuation firm, or you can select a valuation methodology ahead of time (ex: the valuation will be 3x EBIT for the last 12-months)

When I started my first business I was 50/50 partners with my co-founder.

We built a nice business but we disagreed on a lot of things and we didn’t have a strategy to resolve those disagreements. We also never considered what happens if one partner leaves. It caused me a lot of stress and headaches.

In hindsight here what I would do:

1) introduce an independent board member (or have a mechanism that mandates one after 2 years in business).

2) have a share repurchase plan. If a founder leaves, I don’t want them walking away with 40% of the business and riding the coattails of the business. Instead I’d have a mechanism that buys 90% of their shares at Fair Market Value (FMV) over the next 5 years (yearly)

3) include a mechanism to value shares in the future. The best would be FMV is 3-5x EBIT. So perhaps you can use something like this: 3x trailing 12 months earnings under $1M/yr EBIT. 4x at $1-2M/yr EBIT. and 5x at $2M+. Alternatively you can agree hire a 3rd party firm.

4) chose a mediation/arbitration process and person. Include in your document a provision that mandates arbitration, and select a process for how that arbitrator is chosen. You don’t want to leave disputes in the hands of lawyers or a judge. It ends up costing everyone more money and nothing gets resolved (sorry the legal system doesn’t work here the way you think it does).

An arbitrator can take all the information on hand and make a definitive judgement on the outcome if you give them that power in the contract

5) long vesting. The normal 4 years vesting schedule is a trap for founders. It takes 10+ years to build a great company. I would align my vesting schedule with that timeline. Otherwise you may have a founder leave after two years with 25% of the stock! That is highly demotivating to those that stick around.

6) buy preferred shares. Founders will own all of the common stock at founding. But founders should each buy 5-10% preferred shares at founding as well. You can use a SAFE note to buy $5k of shares at $50k valuation. In case things go sideways and the investors own most of the company, it can protect your personal wealth to own the same class of stock as your investors.

Founder Market Fit > Product Market Fit

The first business I started as a sophomore in college was a Learning Management Software for universities.

There’s a big market out there for this product.

But it was a hard sell.

We didn’t have the skills to sell this type of product at the price that was needed.

And we didn’t have the capital to build an enterprise software product that a school could use.

When doing your first company, I’d pick something that is “achievable” for your skill level and the people you have on your team.

If you’re early in your career you need a “win” to give you the confidence and experience to work on bigger harder problems later on as an entrepreneur. So I suggest you start with an easy business that will definitely work.

What’s an easy business? Something the world already needs: plumbing service, HVAC service, painting, landscaping…etc

Business Model > Market Size

Pay attention to things like:

Unit Economics

Cash flow cycle

Sales cycle

If it cost you a lot to build a product with a low margin, you’re not going to make it.

If you have to pay to build the product, and you only get paid 60-120 days later, you have a poor cash conversion cycle which makes your business need more cash (construction is an example of this, eCommerce is another example).

Some products take 1 minute to sell, other products take 12 months to sell. When you’re doing the latter, you have to pay your team’s salary and are taking a lot of risk on them…what if they close nothing in a year and are actually not good at their job? You spent a lot on their salary and got no results. (medical device or government sales are examples of this)

Avoid businesses like this if you’re a first time founder.

Flexibility > Fundraising

Don’t raise money unless you’re very confident you absolutely need it to grow your company 3x from here.

When I ran my first company, I thought raising money would solve my business model problems. We didn’t need it. But it felt cool. We got featured in Techcrunch and all my friends congratulated me.

I've now raised over $50 Million in my career, and each time I raise money people congratulate me.

Why?

Funding is an obligation, it's not a reason for celebration.

Nobody congratulates you on getting a loan on your car.

In the same spirit, we shouldn’t congratulate people for raising money from investors.

My biggest mistake in raising money was I thought we could get big enough that it would solve our unit economic problems (we were not making enough margin on most of our sales).

That was not true. Don’t make the same mistake I did.

Look for businesses that have good economics. Avoid funding.

Growing slowly ensures you build a better, more resilient business.

I’m embarrassed about the decisions I made as a young entrepreneur. Please don’t give me a hard time about it…because I already do.

Have a great week,

Sieva

ps: If you enjoyed today’s email, please consider sending it to a friend 😊

I think it was a great story. Love the tenacity

I love your newsletter and always enjoy it!, but have to say this: the story of the Honduran was the worst example possible to illustrate “hero business man doing huge impact with lack of resources”.